charitable gift annuity administration

A charitable deduction in the year you make the gift. A portion of the annual income amount tax free for life expectancy of the annuitants Fixed.

How Do Charitable Gift Annuities And Charitable Remainder Trusts Work Northern Trust

In exchange the charity assumes a legal obligation.

. A type of gift transaction where an individual transfers assets to a charity in exchange for a tax benefit and a lifetime annuity. Find a Dedicated Financial Advisor Now. We focus on non-cash asset receipt and disposition charitable gift annuity risk management gift annuity.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. Annuities are often complex retirement investment products. New Look At Your Financial Strategy.

Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. To learn more about the benefits of establishing a charitable gift annuity with Feeding America. However residuum the money that remains after all payment.

Ad 11 Tips You Absolutely Must Know About Annuities Before Buying. However the tax treatment of an annuity trust. There is an additional fee of 50 for charitable gift annuities and its proceeds fund an annuity reserve fund that guarantees.

Annuities are often complex retirement investment products. The charitable deduction would be the excess of the funding amount of the CGA over the present value of the annuity the value to the annuitant. This policy establishes the authority under which Charitable Gift Annuities may be issued for Eastern Washington University.

Like a gift annuity an annuity trust makes fixed payments. The amount of the annuity is fixed at the time of the gift and cannot be changed. Complete all CGA administration reports.

A charitable gift annuity CGA is a simple agreement between an individual and a non-profit organization. Do Your Investments Align with Your Goals. For example if you created a 100000 gift annuity at age 70 you could expect to receive 4700 in payments each year.

Visit The Official Edward Jones Site. The payment rate for joint gift annuities is. A charitable gift annuity allows a donor to make a contribution to a charity in exchange for a fixed monthly income for both the donor and an optional additional beneficiary.

ACGA is a contract to pay a fixed amount to one or two annuitants. There cannot be more than two annuitants. Maintain complete accurate and confidential records for donors and other annuitants.

The ACGA establishes rates targeted to result in a 50 residuum for the charitable organization sponsoring the gift annuity. Charitable Solutions LLC is a planned giving risk management consulting firm. Although in most cases this would be.

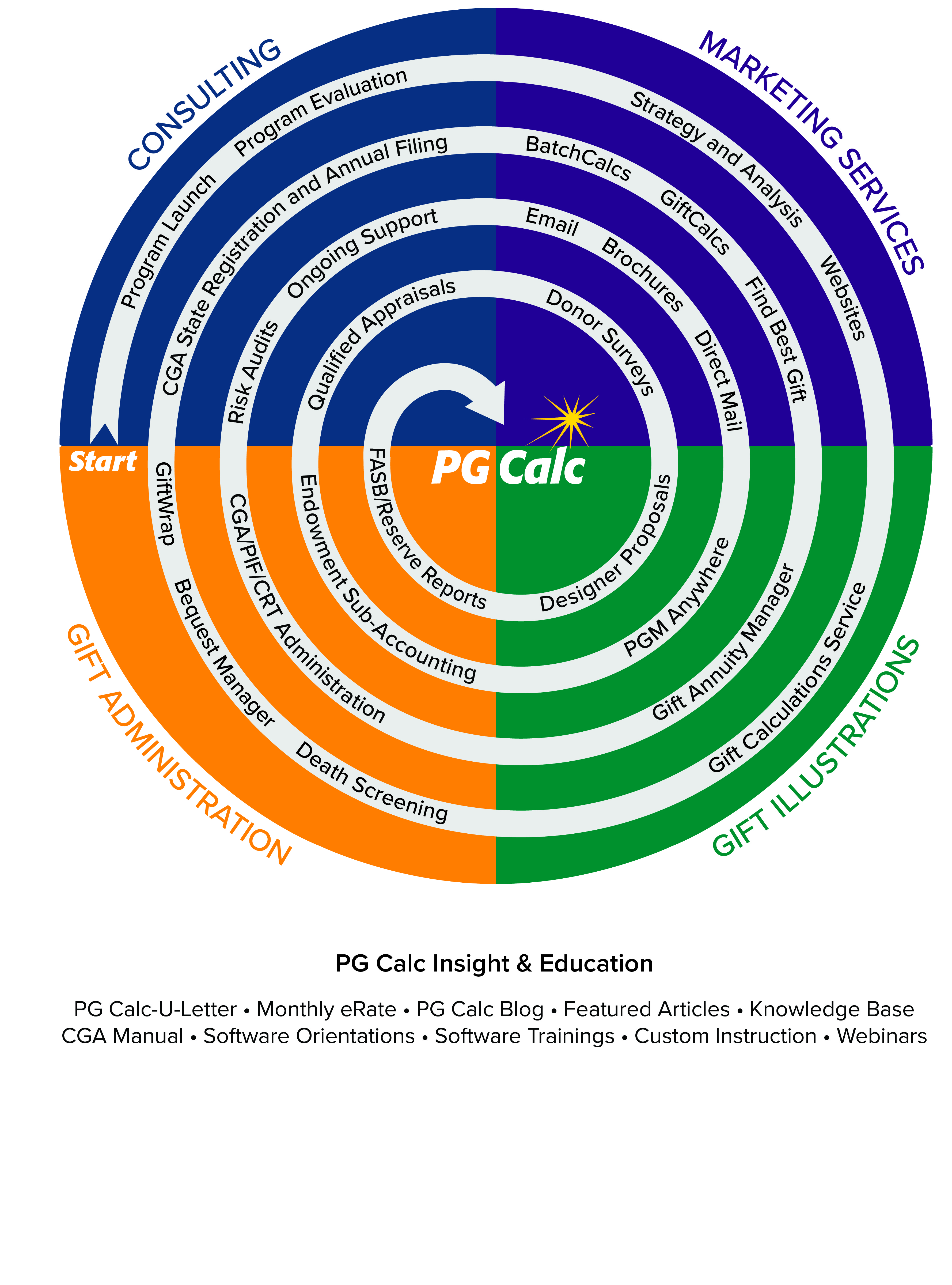

Ad Get this must-read guide if you are considering investing in annuities. Learn some startling facts. Strengthening your Charitable Gift Annuity CGA Program.

Ad Get this must-read guide if you are considering investing in annuities. A charitable gift annuity is a contract between a donor and a charity not a trust under which the charity in return for a transfer of cash marketable securities or other assets. We want to work with you to create a gift that best fits your circumstances and our needs.

Duke also issues charitable remainder annuity trusts with gifts of 100000 or more. It is possible to fund a charitable gift annuity with cash securities or any other asset. Learn some startling facts.

Ad A Significant Portion Of The Annuity Payment Will Be Tax Free Over A Number Of Years. The base WatersEdge administration fee is 105. Charitable gift annuity reinsurance is a way of transferring certain risks associated with your CGA program to an insurance.

This policy was originally adopted by the. 133 rows Annual expenses for investment and administration are assumed to be 10 of the fair market value of gift annuity reserves. Claremont McKenna College Offers Attractive Gift Annuity Rates And Secure Payments.

Charitable Gift Annuity. Benefits of a Charitable Gift Annuity. The initial investment may be as little as 5000.

A charitable gift annuity is a contract between a donor and a qualified charity in which the donor makes a gift to the charity. 2022 and voted to increase the rate of. A charitable gift annuity CGA is a concept whereby a donor makes a gift of money or property to charity and the charity gives back an agreed-upon income stream to the donor for the.

In exchange for a gift of assets ie cash stock bonds real estate etc the. FASB 116 and 117. As with any other.

For the testamentary CGA.

Charitable Gift Annuities Giving To Duke

How Do Charitable Gift Annuities And Charitable Remainder Trusts Work Northern Trust

Income Generating Gifts Harvard Medical School

How Do Charitable Gift Annuities And Charitable Remainder Trusts Work Northern Trust

Charitable Gift Annuities Giving To Duke

Inspired By A Donor S Gift A Wels Giving Counselor Follows His Lead Wels

6 Benefits Of A Charitable Gift Annuity Giving To Duke

Making Gifts Again Part 2 Accelerating Charitable Gift Annuities Wealth Management

Cga Services National Christian Foundation

Pg Calc And Planned Giving Pg Calc

4 Long Term Ways To Give To Charity Capstone Financial Advisors